Cost per Hour Calculator

Table of Contents

What is Cost Per Hour?

Cost Per Hour (CPH) is the amount of money assigned to one hour of work. It's a helpful way to measure how much time-based services or efforts cost. CPH allows people and companies to check productivity, set prices for services, or handle budgets well.

For companies, CPH has a direct impact on costs (like wages and equipment use) and indirect costs (like overheads). For individuals, it shows earnings or what they ask clients to pay for each hour they work.

How to Calculate Cost Per Hour?

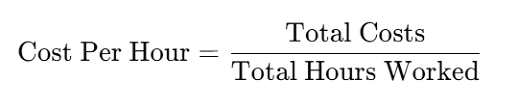

Working out Cost Per Hour is simple, but you need to know your total costs and the total hours worked. Here's the basic formula:

Steps to Calculate Cost Per Hour

1. Identify Total Costs

- For a business: Include labor costs, utility bills, equipment depreciation, and other overheads.

- For an individual: Consider salary, benefits, taxes, and other related expenses.

2. Determine Total Hours Worked:

- Total hours worked over a given period (e.g., monthly, annually).

Apply the Formula:

Divide the total costs by the total hours worked.

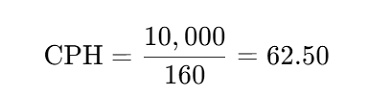

Example:- Total monthly costs = $10,000

- Total hours worked = 160 hours

Your cost per hour is $62.50

Your cost per hour is $62.50How to Determine Your Hourly Rate

Setting your hourly rate involves weighing the time you have, the skills you bring to the table, and the expenses incurred. Use this step-by-step approach:

1. Define Costs

Add up all your costs for rent, utilities, software, equipment, taxes, insurance, and any other business expense.

2. Define Income Goals

Determine how much profit or personal income you want to earn in a month or a year.

3. Estimate Available Work Hours

Vacations, holidays, and time not billed on for administrative work should also be factored in when assessing total working hours for the year.

4. Compute Your Hourly Rate

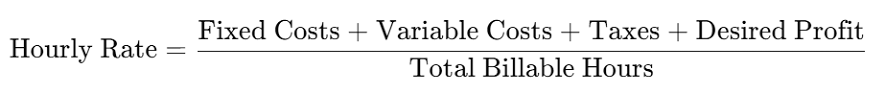

Understand your sustainable hourly rate by applying the following formula:

Example

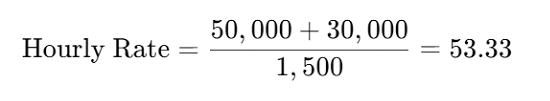

Example- Total annual costs = $50,000

- Desired profit = $30,000

- Total billable hours = 1,500 hours/year

Your hourly rate should be at least $53.33.

Your hourly rate should be at least $53.33.Calculating Hourly Rate Based on Desired Salary

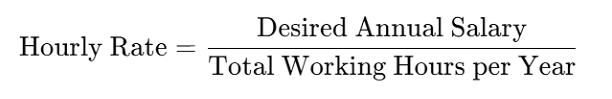

To calculate an hourly rate based on a desired annual salary, you can use the following formula:

Steps to Follow

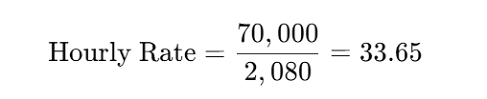

Steps to Follow- Identify your desired annual salary (e.g., $70,000).

- Determine your total working hours in a year (e.g., 40 hours/week × 52 weeks = 2,080 hours).

- Divide your desired salary by the total hours.

- Desired annual salary = $70,000

- Total working hours = 2,080 hours

You need to charge or earn $33.65 per hour to meet your desired salary.

You need to charge or earn $33.65 per hour to meet your desired salary.The Hourly Rate High Enough to Cover Your Expenses

Setting an hourly rate high enough to cover expenses involves the following steps

1. Calculate Your Fixed Costs

Include rent, utilities, software subscriptions, and any ongoing costs.

2. Include Variable Costs

These could be travel expenses, raw materials, or commissions.

3. Add Desired Profit Margin

Ensure your hourly rate accounts for profits above just covering costs.

4. Adjust for Taxes and Unforeseen Expenses

Include taxes, health insurance, and emergency savings.

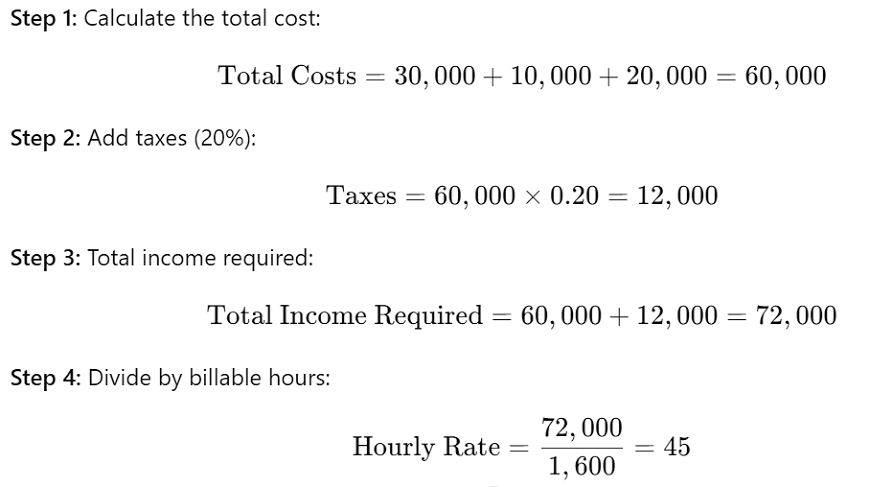

Formula Example

Example- Fixed costs = $30,000/year

- Variable costs = $10,000/year

- Desired profit = $20,000/year

- Taxes = 20% of total income

- Total billable hours = 1,600 hours/year

Step 1: Calculate the total cost:

You need to charge at least $45/hour to cover expenses and taxes while earning your desired profit.

You need to charge at least $45/hour to cover expenses and taxes while earning your desired profit.